Businesses often find themselves in a position where the services or products they offer require taxation to maintain compliance with local, state, or federal regulations. NetSuite offers many opportunities for businesses to leverage native and 3rd party applications for tax management. Within this article we will discuss a few important considerations we feel you all companies should consider when making their decision between native functionality or 3rd party applications.

Analyzing NetSuite’s Tax Capabilities

Within NetSuite, you have several options for managing tax collection. However, before diving into these options, it’s essential for businesses to consider a few key aspects regarding taxes. It is crucial to have a comprehensive understanding of where tax collection is required, how your business should report these taxes, and the appropriate timelines for tax payments. Once these factors have been taken into consideration you can choose one of these 3 options for tax collection: NetSuite SuiteApp, NetSuite SuiteTax, or 3rd Party Applications.

NetSuite SuiteApp

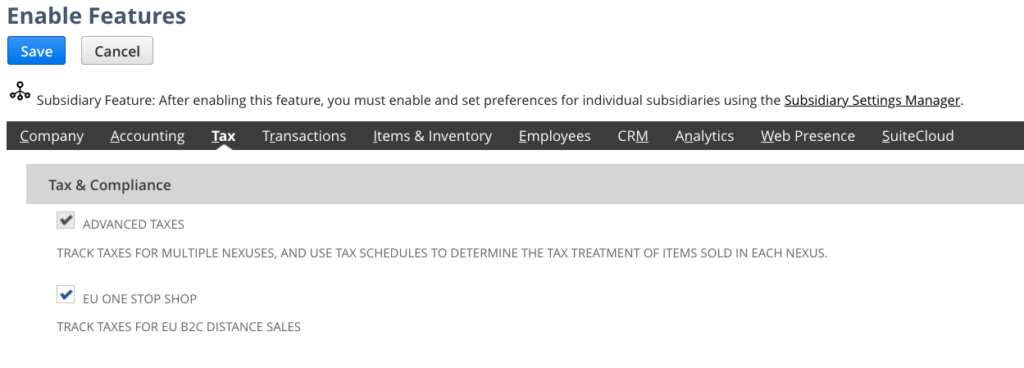

- Advanced Taxes

- Custom Records

- Service SuiteScript

- Client SuiteScript

The SuiteApp provides a comprehensive set of features for tax management in NetSuite. It allows you to define tax types, tax codes, and tax groups, as well as set up default tax codes for streamlined operations. To accurately track taxes within the SuiteApp, it is essential to specify the appropriate tax codes on your transaction records. These tax codes contain crucial information about tax rates and the specific types of transactions to which they should be applied. Additionally, tax codes need to be properly configured with the correct tax control accounts and tax types to ensure accurate posting of taxes to the general ledger.

For accounts with Advanced Taxes enabled, it is necessary to set up tax schedules to determine how NetSuite calculates taxes for items in each nexus. When installing this bundle, or the international version of the bundle for tax collection outside the US, it’s important to note that adding a new country nexus will automatically provision the VAT/GST tax codes for that nexus.

It’s worth mentioning that tax authorities rarely announce changes to tax rates, and tax rules can vary significantly. Therefore, it becomes the responsibility of System Administrators within NetSuite to update tax rate changes promptly upon notification from the finance team. It is highly recommended to carefully study the rates and associated changes before making any adjustments within your NetSuite account to ensure accurate tax calculations and compliance.

NetSuite SuiteTax

- Intercompany Journals are not yet supported by SuiteTax.

- Form customizations of Tax Details are not supported.

- Finance Charges are not supported by SuiteTax.

- SuiteTax does not support Tax Liability and Sales Tax Payments.

- SuiteTax integration with OpenAir is not supported.

- Certain SuiteCommerce functionality may have additional limitations under SuiteTax.

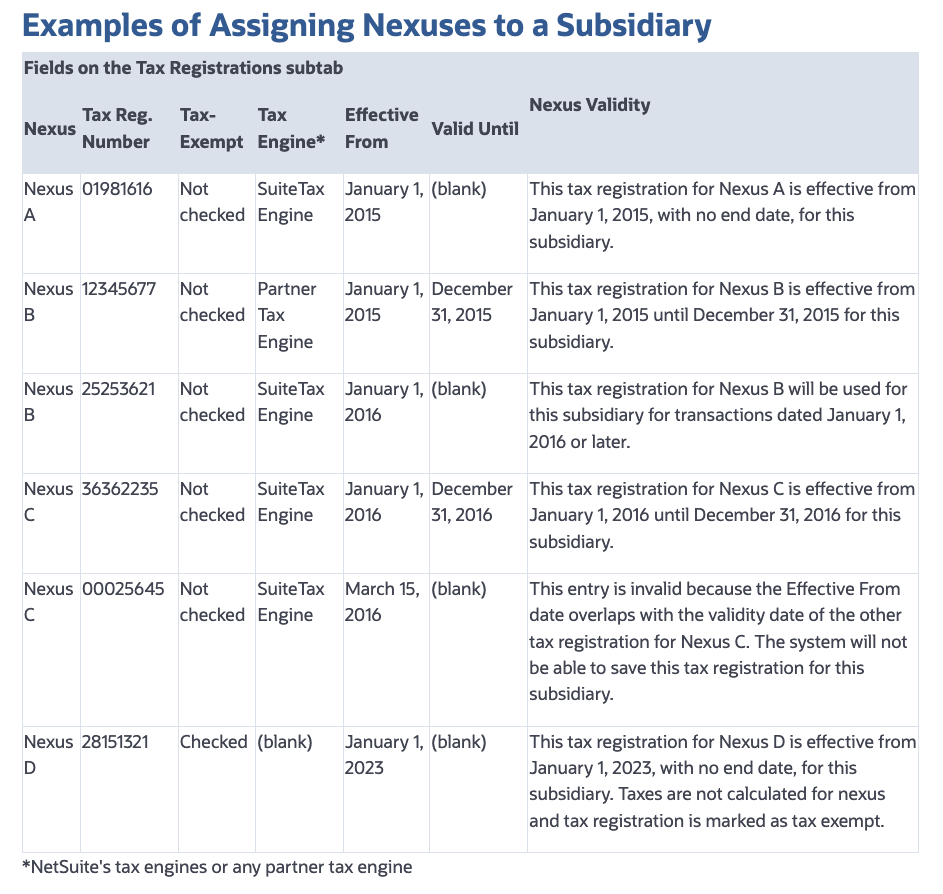

The SuiteTax API utilizes internal or external tax engines to calculate taxes for transactions within NetSuite. Each tax engine represents an implementation of the SuiteTax plug-in feature, defining the specific process by which taxes are calculated. With SuiteTax, companies can utilize different tax engines for each established nexus, allowing for flexibility in tax calculations. It’s important to ensure that each nexus has a corresponding tax registration number specified on the Tax Registrations subtab of the subsidiary record.

Third Party Applications

If after you have analyzed NetSuite’s Core functionality and you find it not to your liking, there are various third-party applications available that can enhance the capabilities and flexibility of NetSuite. These applications provide additional features and integrations that can greatly benefit your business. Here are a few noteworthy third-party applications:

- Avalara: Avalara supports over 700+ prebuilt integrations with popular accounting, ERP, ecommerce, shopping cart, and other applications. It offers comprehensive solutions for automating tax calculations, managing compliance, and staying up to date with tax regulations. With Avalara, you can streamline your tax processes and ensure accurate tax calculations across various systems.

- Vertex: Vertex offers a range of solutions to streamline sales and use tax management. It provides automated tax calculations and updates, allowing you to handle functions, locations, and channels with ease. Vertex offers hybrid deployment options, allowing you to customize your tax technology based on your specific business needs.

- Thomson Reuters: Thomson Reuters provides professional tax software, research, and guidance solutions. These tools enable you to complete tax returns more efficiently and offer comprehensive resources to become a full-service tax and financial advisory resource for your clients. Thomson Reuters equips your firm with the necessary tools for enhanced tax management and client support.

By integrating these third-party applications into NetSuite, businesses can further optimize their tax management processes, improve compliance, and access additional resources and functionalities. Each of these applications brings unique features and benefits, allowing you to choose the one that best suits your business requirements.

Do you have more Questions?

Regardless of what version, you elect and/or what 3rd Party Application you may decide to utilize always do your research and ask as many questions as possible. TAC Solutions Group is a Certified NetSuite Solutions Provider as well as an Avalara Certified Implementation Partner and we are here to answer any lingering questions you may have about NetSuite’s Taxation capabilities or offerings, you can contact us here.